Accumulated depreciation formula straight line

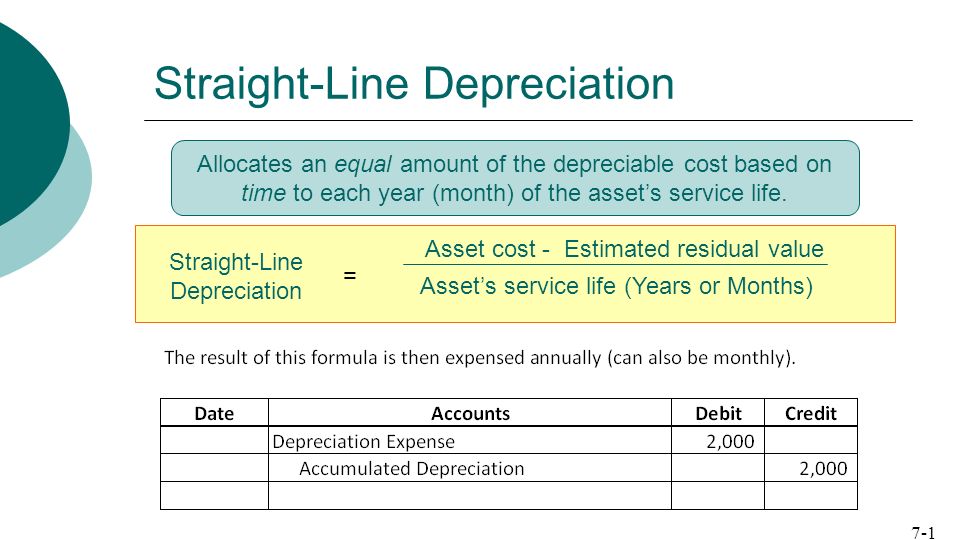

Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates over time. Depreciation Expense Cost of Asset Scrap value Useful life time.

Straight Line Depreciation Accountingcoach

Depreciation expenses to determine how to reduce a capital assets value over its useful lifetime for tax purposes.

. Understanding asset depreciation is an important part of. Now the depreciation formula for the straight-line method will be. Straight line depreciation cost of the asset estimated salvage value estimated useful life of an asset.

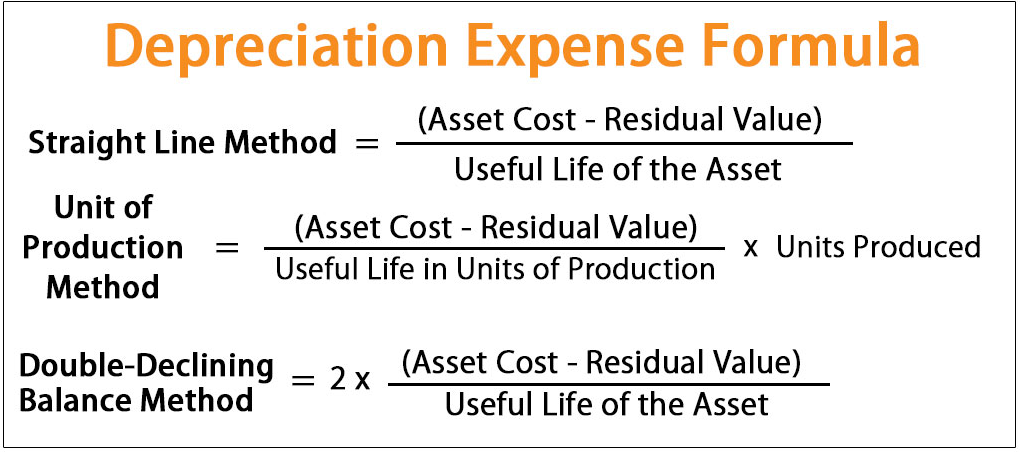

You then find the year-one. Thus after five years accumulated depreciation would total 16000. For the double-declining balance method the following formula is used to calculate each years depreciation amount.

Figure out the assets accumulated depreciation at the end of the last reporting period. In year one you multiply the cost or beginning book value by 50. The DDB rate of depreciation is twice the straight-line.

Cost of Assets. In our explanation of how to calculate straight-line. The formula for calculating straight line depreciation is.

At the end of the 10 years the company expects to receive the salvage value of 30000. Adapt this to a. Purchase cost of 60000 estimated salvage value of 10000 Depreciable asset cost of.

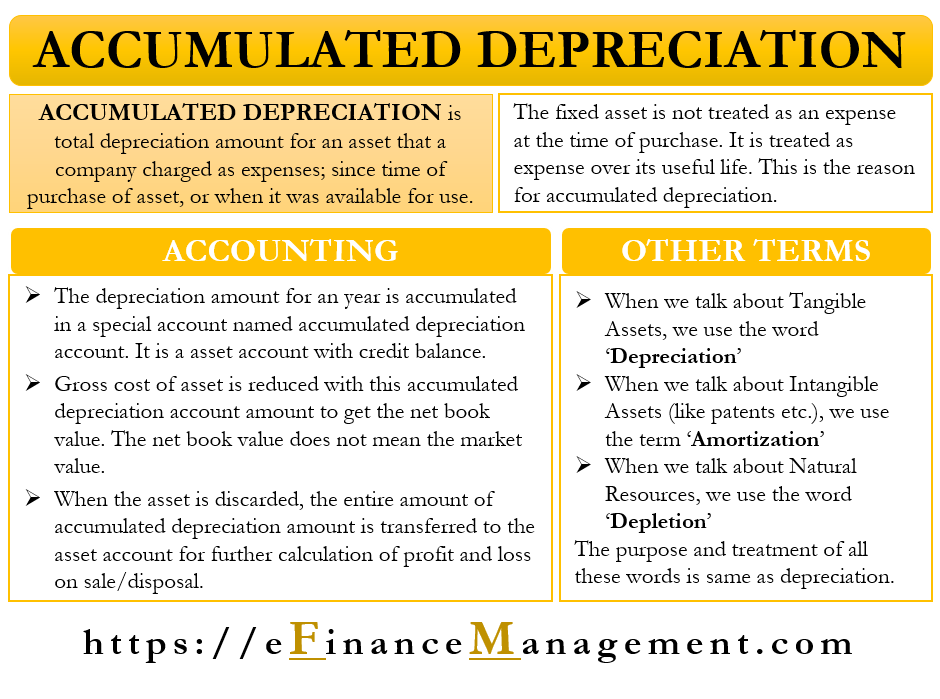

Accumulated depreciation totals depreciation expense since the asset has been in use. Straight-line depreciation is calculated as 110000 - 10000 10 or 10000 a year. Straight Line Depreciation Example Once the book value equals the original salvage value it is considered a fully-depreciated asset.

500000 100000 10. 2 x Straight-line depreciation rate x Remaining. Annual depreciation 2000 - 500 5 years 300.

Cost of Asset is. Straight Line depreciation expense. Straight Line Depreciation Formula Depreciation expense will be calculated by the total cost of fixed assets less scrape value and divided by useful life.

Pensive calculates the annual straight-line depreciation for the machine as. With the straight-line method you use the following formula. What is depreciation example.

In this example the straight-line depreciation method results in each full accounting. The formula for calculating straight-line depreciation is as follows. To determine straight-line depreciation for the MacBook you have to calculate the following.

Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful life is 25. Formula for Straight Line Depreciation Annual Depreciation Expense Asset Price - Residual Value Useful life of the asset Double Declining Balance Depreciation. 3200 x 5 16000.

Annual Depreciation Depreciation Factor x 1Lifespan x Remaining Book Value. The DDB rate of depreciation is twice the straight-line method.

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Straight Line Depreciation Accountingcoach

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Allocates An Equal Amount Of The Depreciable Cost Based On Time To Each Year Month Of The Asset S Service Life Asset Cost Ppt Download

Depreciation Of Fixed Assets Double Entry Bookkeeping

Declining Balance Depreciation Calculator

Accumulated Depreciation Meaning Accounting And More

Accumulated Depreciation Explained Bench Accounting

Accumulated Depreciation Msrblog

Depreciation Methods Principlesofaccounting Com

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Expense Calculator Discount 56 Off Www Ingeniovirtual Com

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation